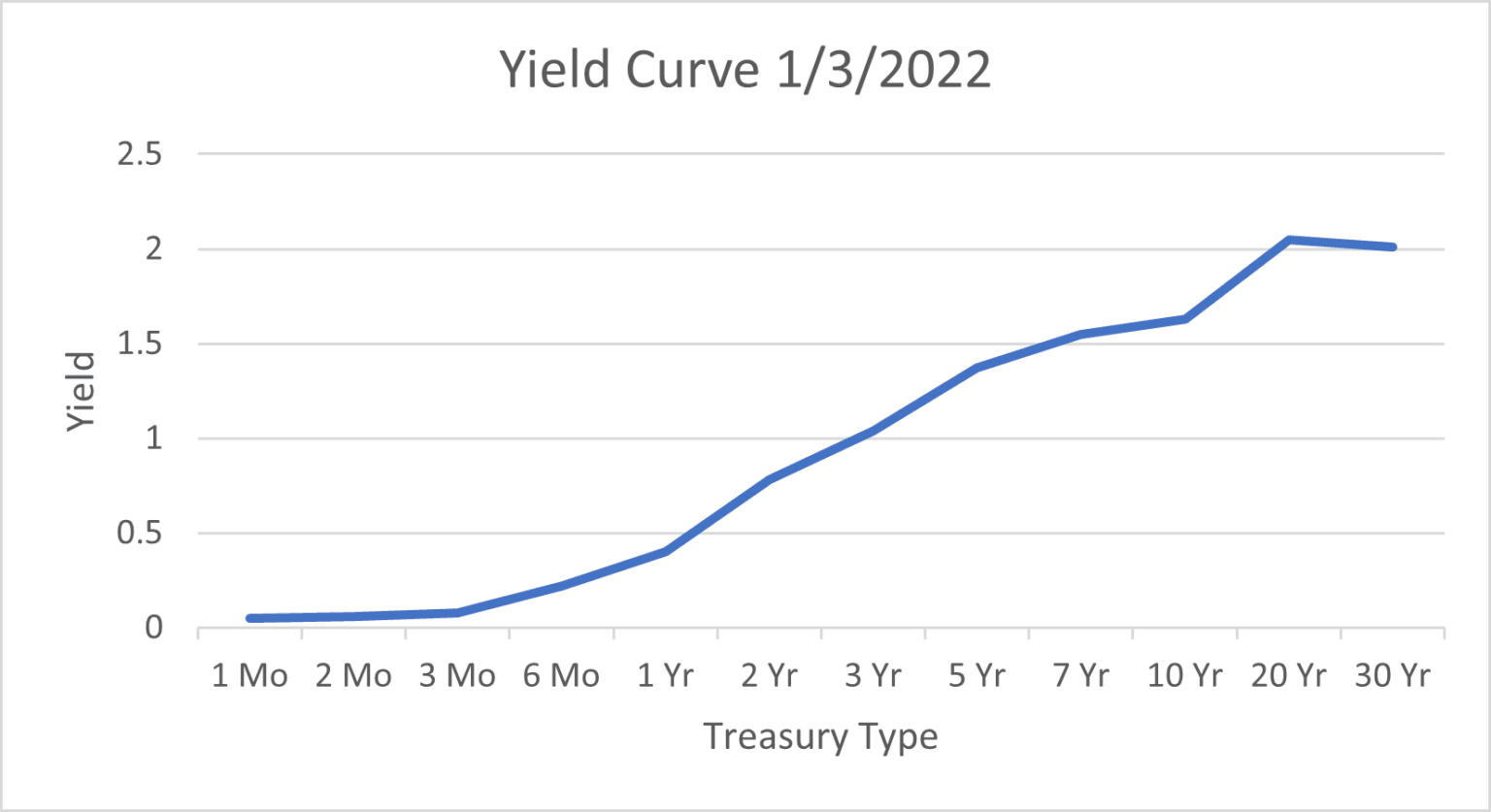

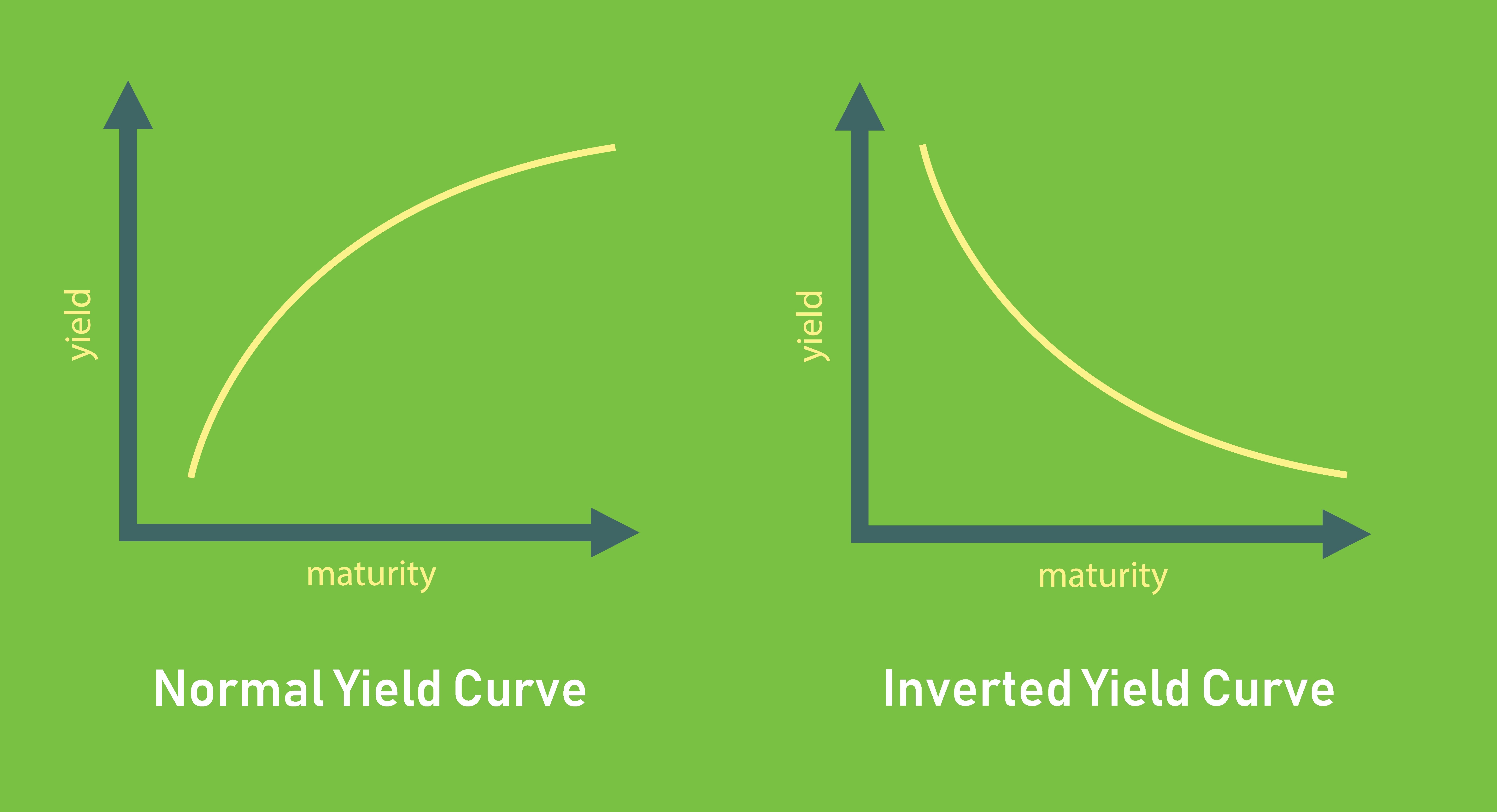

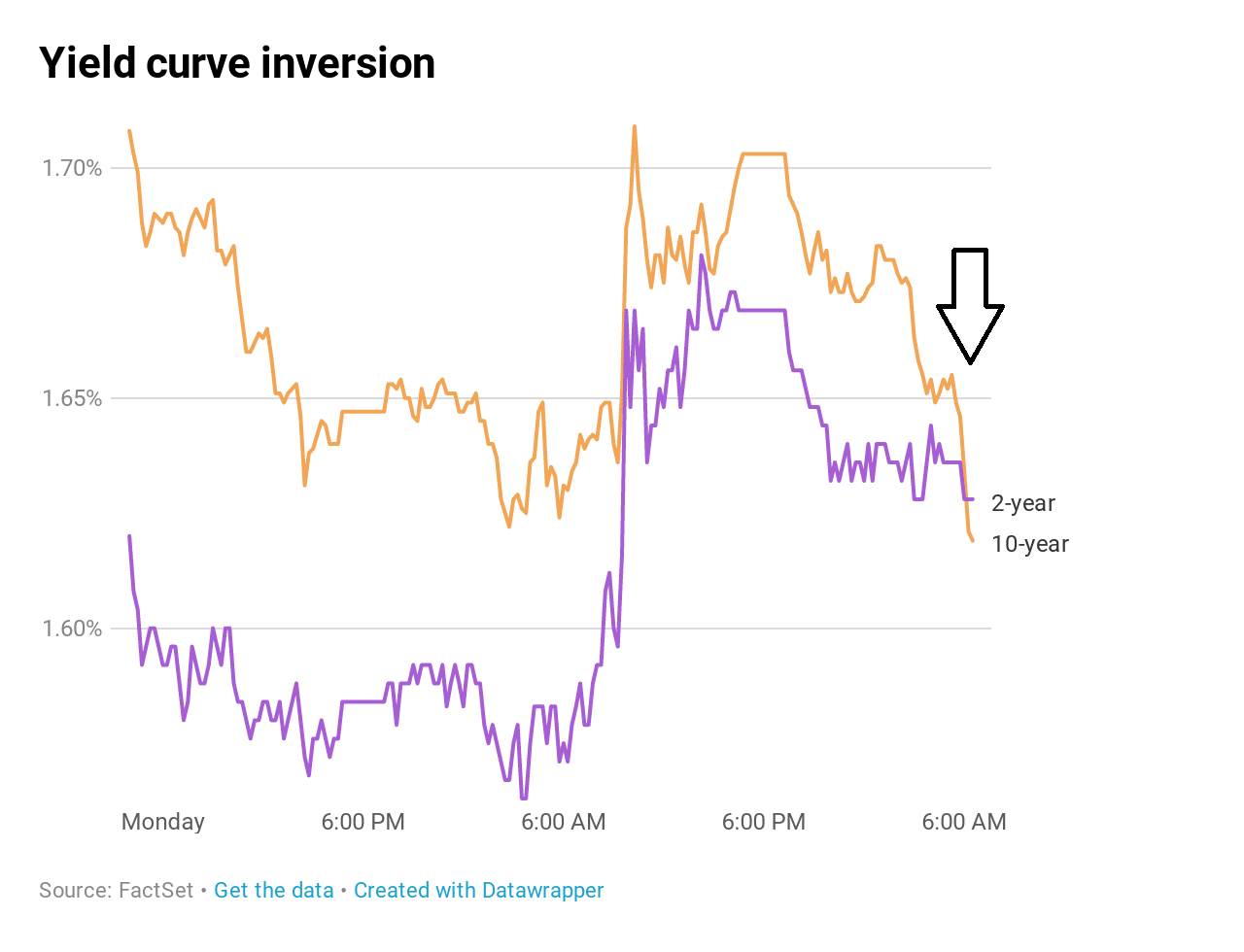

Look At The Below Yield Curve Inversion Chart

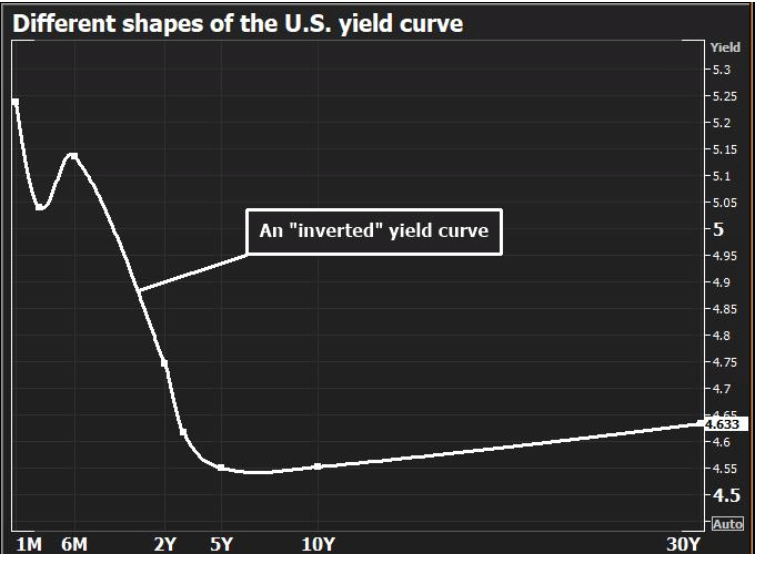

Look At The Below Yield Curve Inversion Chart - We look specifically at the difference in yield between treasuries maturing in. Web the yield curve is still inverted, but it's become significantly less inverted over the past several weeks. Positive values may imply future growth, negative values may imply economic downturns. The gray bars throughout the charts indicate the past u.s. With the tame cpi report, the odds of a september rate hike have risen to above 90%. Inverted yield curves can be. What is most likely to happen as a result of the most recent yield curve inversion shown? Web the yield curve is a visual representation of how much it costs to borrow money for different periods of time; What is most likely to happen as a result of the most recent yield curve inversion shown? We typically look at u.s. Web what is the yield curve inversion chart? Web the yield curve is a visual representation of how much it costs to borrow money for different periods of time; After topping out at 6.24 years in 2023, the average weighted maturity of the debt is 5.91 years. Treasury debt at different maturities at a given. Web here is a quick primer explaining what a steep, flat or inverted yield curve means and how it has in the past predicted recession, and what it might be signaling now. Web this chart from the st. Web a yield curve plots the interest rates of bonds that have equal credit quality but different maturity dates. Web look at the below yield curve inversion chart. The yield falls off as the maturity date gets further away when the yield curve is inverted. This chart shows the nominal real yield curve. All data is sourced from the daily treasury par yield curve rates data provided by the treasury.gov website. Knowledge check look at the below yield curve inversion chart. Web the us treasury yield curve rates are updated at the end of each trading day. Web the chart below shows the true danger of the recent drop in the overall maturity. View the full answer answer. The gray bars throughout the charts indicate the past u.s. Gdp will rise gdp will dip term premium will rise. Web a yield curve plots the interest rates of bonds that have equal credit quality but different maturity dates. Treasury debt at different maturities at a given. The three types are normal, inverted, and flat. Gdp will rise gdp will dip term premium will rise. When they flip, or invert, it’s widely regarded as a bad. Web what is the yield curve inversion chart? Web the chart below shows the true danger of the recent drop in the overall maturity of the debt. Knowledge check look at the below yield curve inversion chart. Inverted yield curves can be. Web the yield curve is still inverted, but it's become significantly less inverted over the past several weeks. When they flip, or invert, it’s widely regarded as a bad. Web the chart below shows the true danger of the recent drop in the overall maturity. Web a yield curve plots the interest rates of bonds that have equal credit quality but different maturity dates. Knowledge check look at the below yield curve inversion chart. All data is sourced from the daily treasury par yield curve rates data provided by the treasury.gov website. We look specifically at the difference in yield between treasuries maturing in. Web. Web the table below shows that the current streak of inverted yield curves is the longest in the u.s. Web the chart below shows the true danger of the recent drop in the overall maturity of the debt. Inverted yield curves can be. Web the yield curve is still inverted, but it's become significantly less inverted over the past several. This chart shows the nominal real yield curve. The yield falls off as the maturity date gets further away when the yield curve is inverted. Gdp will dip if the curve inversion is a sign of recession, we'd expect the gpd to go lower or negative. After topping out at 6.24 years in 2023, the average weighted maturity of the. With the tame cpi report, the odds of a september rate hike have risen to above 90%. When they flip, or invert, it’s widely regarded as a bad. It shows interest rates on u.s. Web here is a quick primer explaining what a steep, flat or inverted yield curve means and how it has in the past predicted recession, and. The yield falls off as the maturity date gets further away when the yield curve is inverted. Here is a quick primer on what an inverted yield curve means, how it has predicted recession, and what it might be. Web the longer yield curve indicative of the former with yesterday's bear steepening. What is most likely to happen as a. We look specifically at the difference in yield between treasuries maturing in. What is most likely to happen as a result of the most recent yield curve inversion shown? Web so what does an inverted yield curve look like, and what does it signal about an economy? We typically look at u.s. At the same time, the weighted average interest. Web the yield curve is still inverted, but it's become significantly less inverted over the past several weeks. We typically look at u.s. What is most likely to happen as a result of the most recent yield curve inversion shown? Web the us treasury yield curve rates are updated at the end of each trading day. Web the yield curve inversion suggests potential economic concern. Web look at the below yield curve inversion chart. Inflation to the 2's of the tens and the curve is inverted. With the tame cpi report, the odds of a september rate hike have risen to above 90%. The yield falls off as the maturity date gets further away when the yield curve is inverted. Gdp will rise gdp will dip term premium will rise. Gdp will dip if the curve inversion is a sign of recession, we'd expect the gpd to go lower or negative. Inverted yield curves can be. What is most likely to happen as a result of the most recent yield curve inversion shown? Web the chart below shows the true danger of the recent drop in the overall maturity of the debt. Web the longer yield curve indicative of the former with yesterday's bear steepening. This chart shows the nominal real yield curve.The Yield Curve Is Inverted And It's Okay

Look At The Below Yield Curve Inversion Chart

Solved Look at the below yield curve inversion chart. What

Solved Look at the below yield curve inversion chart. What

Trading 101 The inversion of the US Treasury yield curve

Inverted Yield Curve Definition, What It Can Tell Investors, and Examples

Solved Look at the below yield curve inversion chart. What

OneClass Look at the below yield curve inversion chart. What is most

What is a Yield Curve Inversion and Why Does it Matter? ADM

Inverted Yield Curve Chart

Web The Yield Curve Is A Visual Representation Of How Much It Costs To Borrow Money For Different Periods Of Time;

Web What Is The Yield Curve Inversion Chart?

View The Full Answer Answer.

Web An Inverted Treasury Yield Curve Is Typically Seen As A Harbinger Of Recession, Although The U.s.

Related Post:

.1566418097341.png)

:max_bytes(150000):strip_icc()/InvertedYieldCurve2-d9c2792ee73047e0980f238d065630b8.png)