Life Insurance Bmi Chart

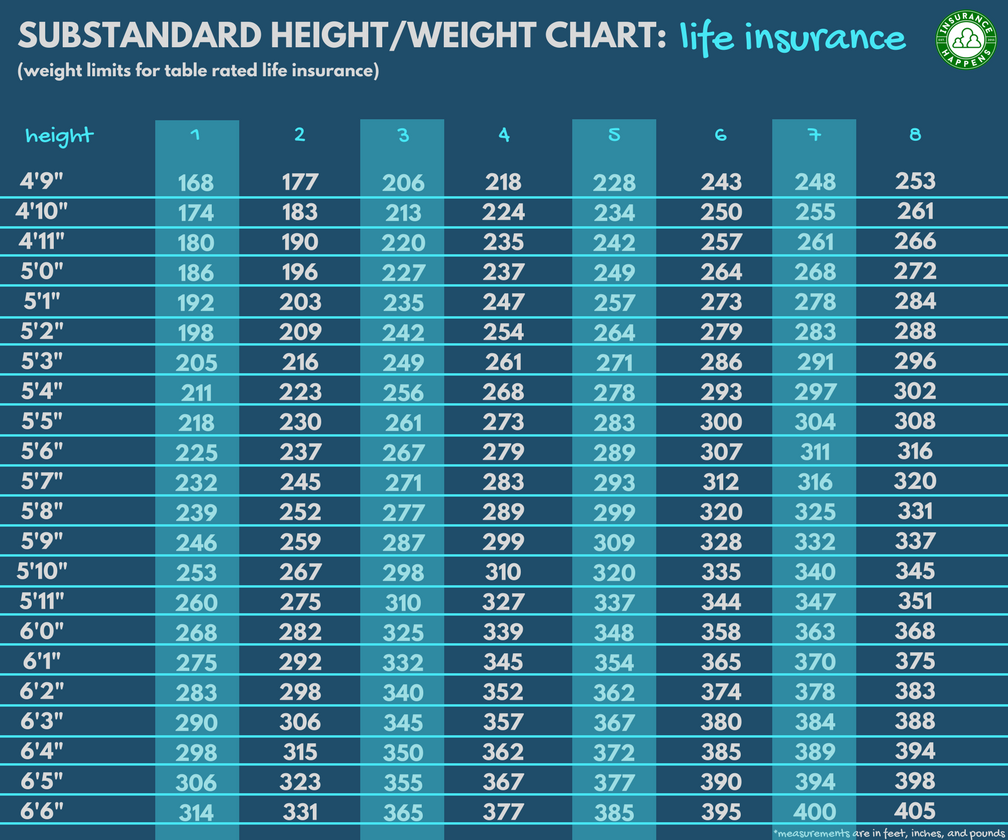

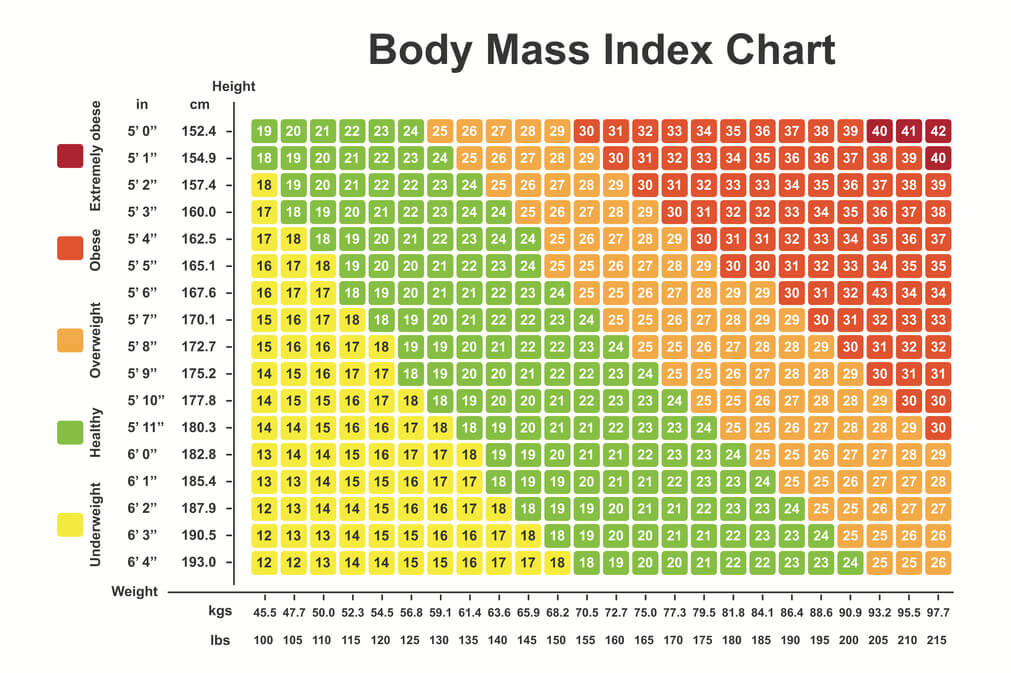

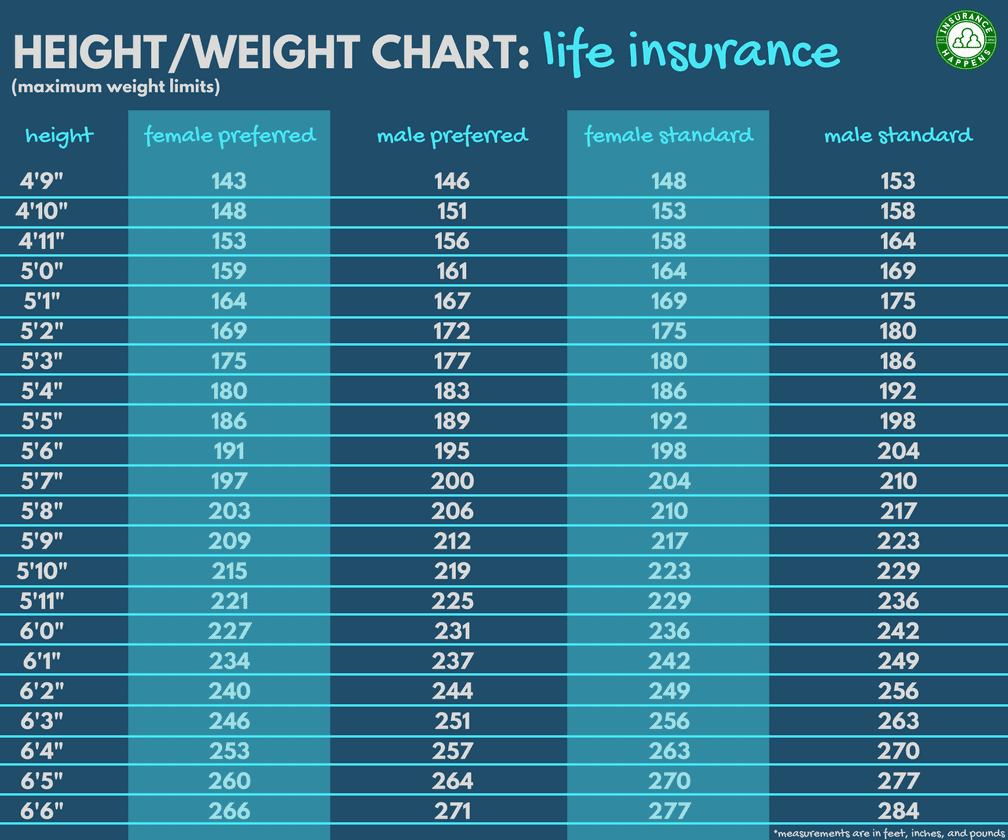

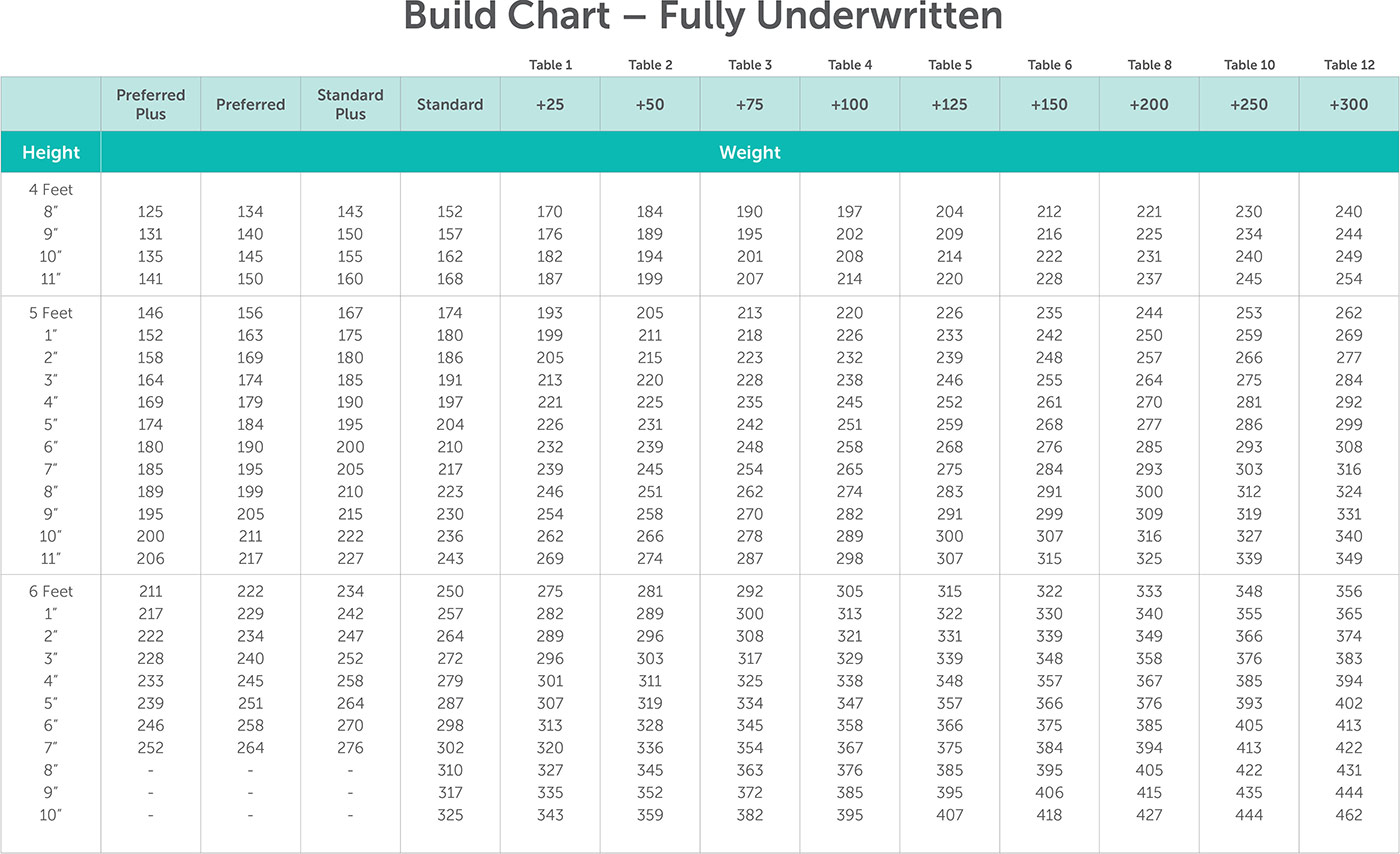

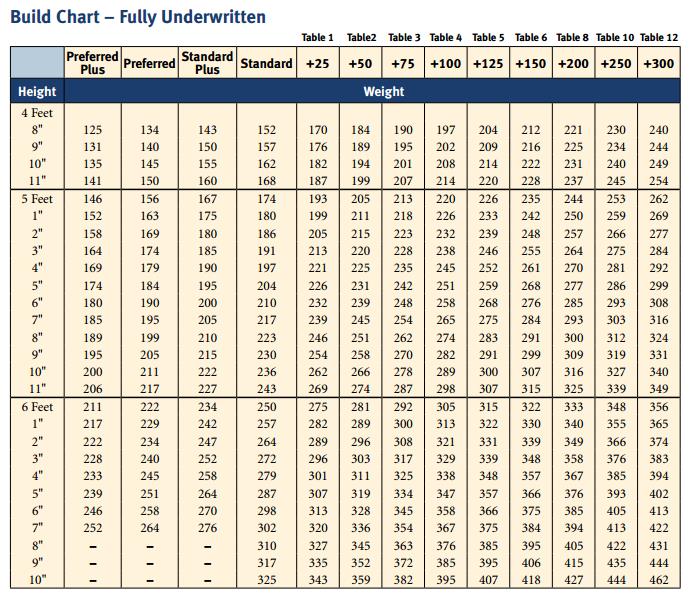

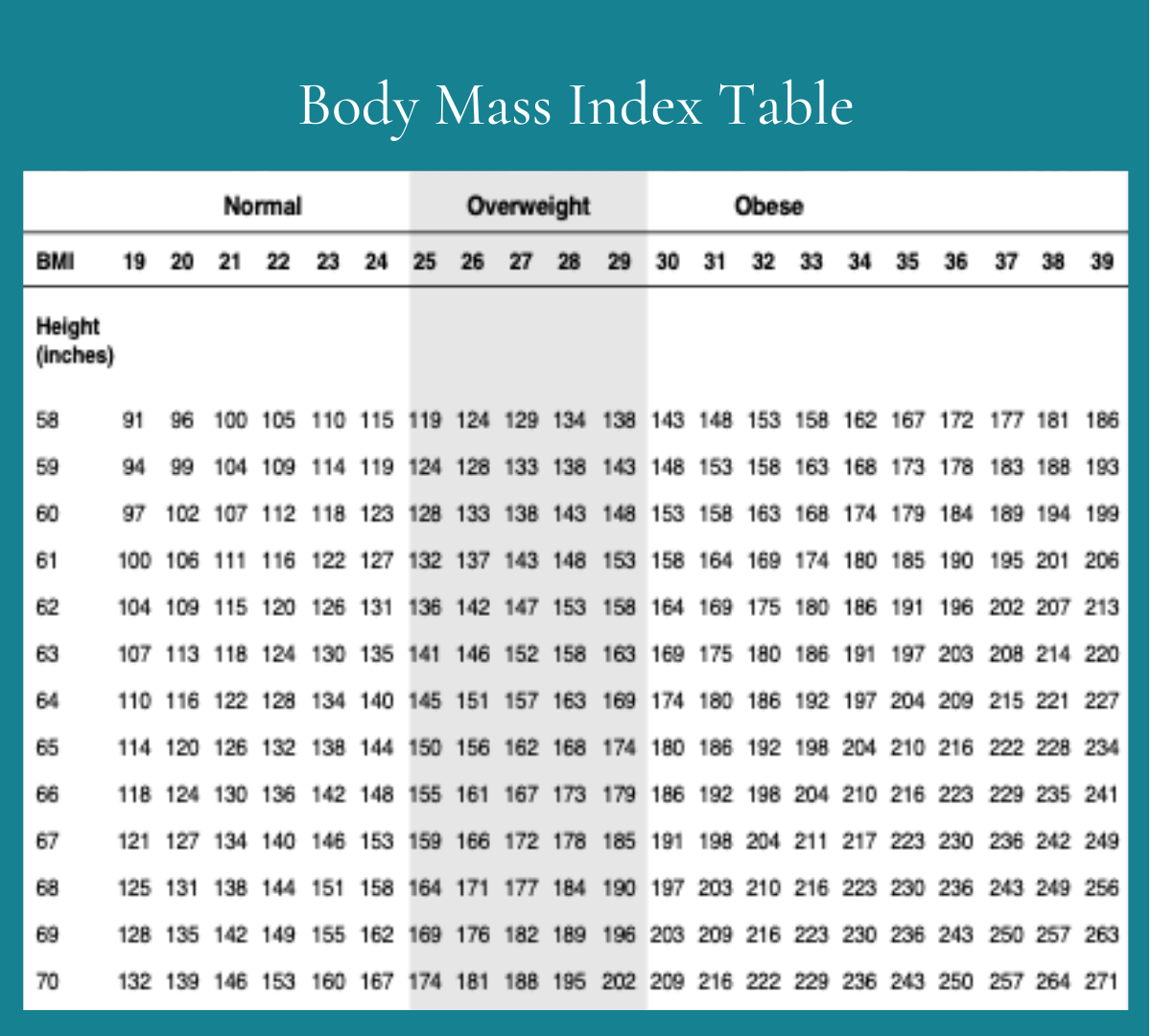

Life Insurance Bmi Chart - The bmi chart below from the cdc shows standard weight status categories. Life insurance companies use your bmi information to determine your monthly premiums or life insurance rates. Web a few carriers use body mass index (bmi) to determine rate classification. Web each life insurance company has its own “build chart,” which lists heights and the maximum allowable weights for each price class. Web height and weight underwriting guidelines are important factors that life insurance companies use to help determine your rate class. Web use the bmi calculator to quickly determine your body mass index. Understand bmi's role in underwriting and tips for better rates. Find out how it could impact the amount you pay for coverage. Enter your client's age, height and weight to calculate their body mass index and premium loading. Web the cdc offers guidelines for calculating overweight and obesity by using body mass index. Web use the bmi calculator to quickly determine your body mass index. The upper limit before an automatic decline is very high and even higher for seniors. Your height and weight will help an underwriter determine your overall health. For children and teens 2 through 19, use cdc's bmi calculator for child and teen. Web the cdc offers guidelines for calculating overweight and obesity by using body mass index. But you may expect higher premiums. Web a few carriers use body mass index (bmi) to determine rate classification. Web discover how height and weight impact life insurance coverage and premiums. Web body mass index (bmi) is a medical screening tool that categorizes an individual as underweight, at a healthy weight, overweight, or obese. This guide explains how weight, bmi, and build charts affect rates. Web build charts vary by company, which means you may fall into more favorable life insurance weight limits with some insurers than others. The table ranges from a. Life insurance build charts can be more generous than other bmi classifications, and there's no industry standard for how insurers use bmi to make application decisions and determine rates. Web our bmi. Max life insurance bmi calculator helps men and women to know whether they are overweight, underweight, or just adequate. This guide explains how weight, bmi, and build charts affect rates. The upper limit before an automatic decline is very high and even higher for seniors. But you may expect higher premiums. In some cases, a person who is obese by. Web worried about life insurance costs if you're overweight? Web based on bmi, the life insurance height weight chart helps set the price of your policy. This guide explains how weight, bmi, and build charts affect rates. Bmi limits are the same for both men and women. Web commonly known as a build chart, life insurance providers generally have guidelines. Web use this calculator to determine the estimated bmi (body mass index) and associated rate class your client may be eligible for under aig underwriting guidelines. To calculate bmi by hand, use the formulas below: Web learn how life insurance weight limits may impact your ability to obtain a life insurance policy, how weight affects rates, and how to shop. The life insurance height weight chart plays an important role in underwriting. Web when you apply for life insurance you will have to meet certain underwriting guidelines in order to qualify, each insurance company will use an insurance weight chart and to determine your rate class. But you may expect higher premiums. Web will being overweight impact life insurance rates?. Medical and personal benefits can range from things such as reducing blood pressure, reduced risk of developing diabetes, having more energy, better sleep, and improvement in mobility. These charts also tend to be more forgiving than bmi. Understand bmi's role in underwriting and tips for better rates. Web discover how height and weight impact life insurance coverage and premiums. Find. Web a few carriers use body mass index (bmi) to determine rate classification. Find out how it could impact the amount you pay for coverage. Enter your client's age, height and weight to calculate their body mass index and premium loading. Web life insurance rates are higher if you have overweight or a high bmi, since companies take into account. Web height and weight underwriting guidelines are important factors that life insurance companies use to help determine your rate class. Web commonly known as a build chart, life insurance providers generally have guidelines limiting how much you can weigh based on your height. Bmi limits are the same for both men and women. For the severely obese, class 3 a. Web life insurance bmi chart (male & female) below is a sample bmi life insurance underwriting guideline chart from one of the top life insurance companies in the country. Enter your client's age, height and weight to calculate their body mass index and premium loading. The bmi chart below from the cdc shows standard weight status categories. Max life insurance. To calculate bmi by hand, use the formulas below: Web body mass index (bmi) is a medical screening tool that categorizes an individual as underweight, at a healthy weight, overweight, or obese. Life insurance companies use your bmi information to determine your monthly premiums or life insurance rates. Web a few carriers use body mass index (bmi) to determine rate. Web body mass index (bmi) is a medical screening tool that categorizes an individual as underweight, at a healthy weight, overweight, or obese. Web height and weight underwriting guidelines are important factors that life insurance companies use to help determine your rate class. Enter your client's age, height and weight to calculate their body mass index and premium loading. Web the cdc offers guidelines for calculating overweight and obesity by using body mass index. To calculate bmi by hand, use the formulas below: Web having a healthy bmi may help you to secure lower life insurance premiums and simply improve your overall health. But you may expect higher premiums. Life insurance build charts can be more generous than other bmi classifications, and there's no industry standard for how insurers use bmi to make application decisions and determine rates. Web life insurance bmi chart (male & female) below is a sample bmi life insurance underwriting guideline chart from one of the top life insurance companies in the country. This guide explains how weight, bmi, and build charts affect rates. Web commonly known as a build chart, life insurance providers generally have guidelines limiting how much you can weigh based on your height. Web build charts vary by company, which means you may fall into more favorable life insurance weight limits with some insurers than others. Web will being overweight impact life insurance rates? Web insurers typically use a life insurance bmi chart to determine rates, often leading to higher premiums for those with a high bmi. But unless you have other health issues, such as limited mobility due to having morbid obesity, you're unlikely to be rejected for life insurance coverage. For example, a bmi over 25 or even over 30 won’t automatically disqualify you from coverage.Overweight Life Insurance

Bone Mass Calculator

Overweight Life Insurance

Bmi Chart Good Or Bad Aljism Blog

Use BMI Calculator To Check BMI Online Tata AIA Life Insurance

Life Insurance Bmi Chart

Life Insurance Bmi Chart

Life Insurance Bmi Chart Ponasa

BMI Calculator Life Well Lived

Height and Weight Impact (BMI) on Life Insurance in Canada [2024

Life Insurance Companies Use Your Bmi Information To Determine Your Monthly Premiums Or Life Insurance Rates.

Web Learn How Life Insurance Weight Limits May Impact Your Ability To Obtain A Life Insurance Policy, How Weight Affects Rates, And How To Shop For A Policy.

Web Use The Bmi Calculator To Quickly Determine Your Body Mass Index.

The Upper Limit Before An Automatic Decline Is Very High And Even Higher For Seniors.

Related Post: