Hammer Charts Candlesticks

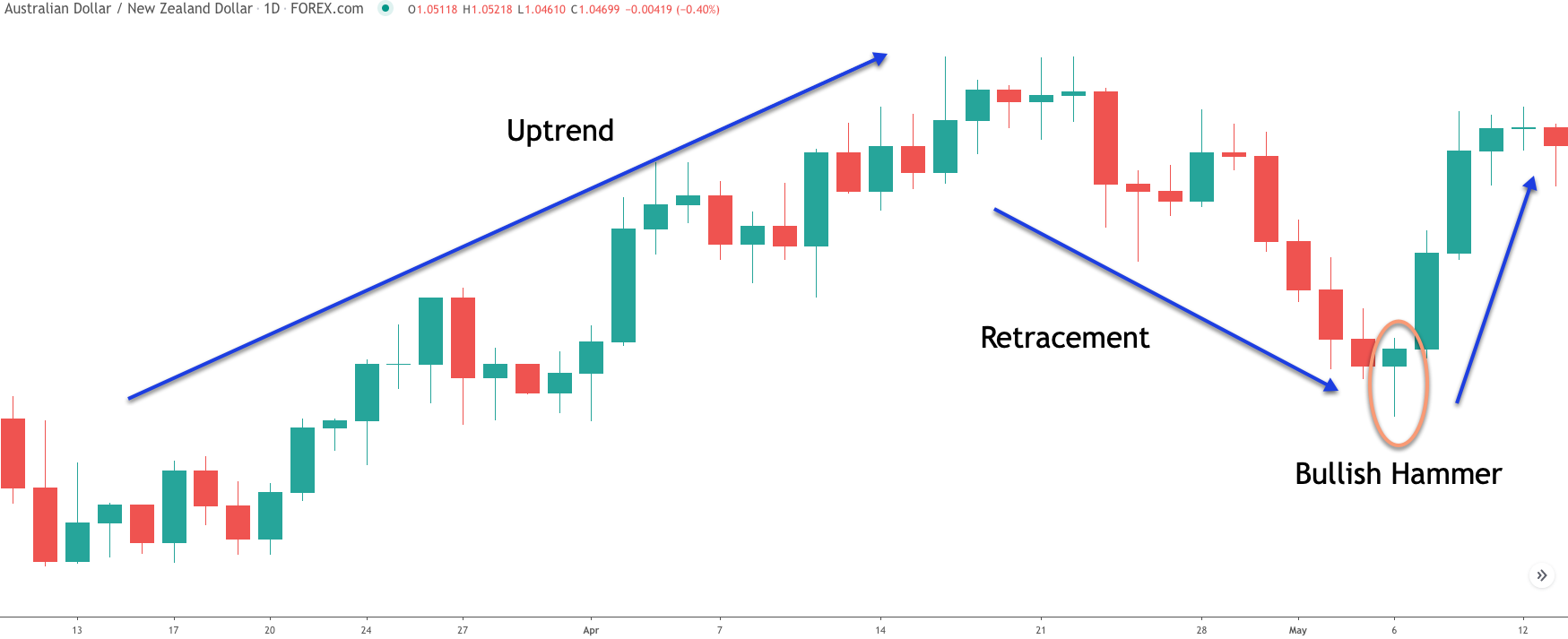

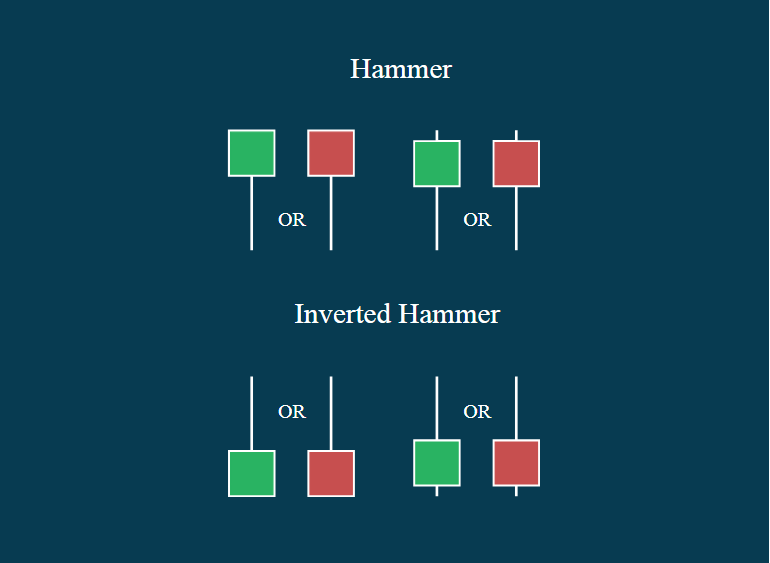

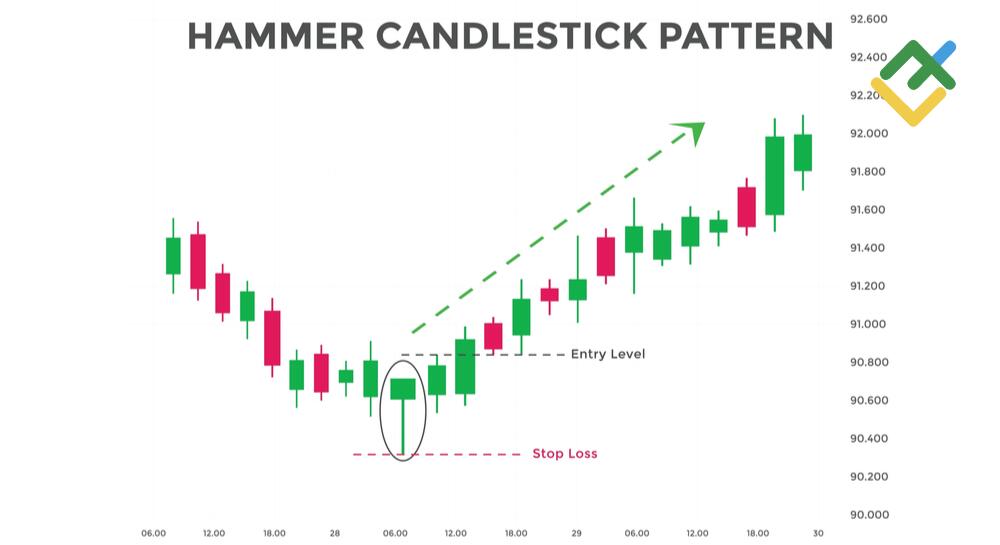

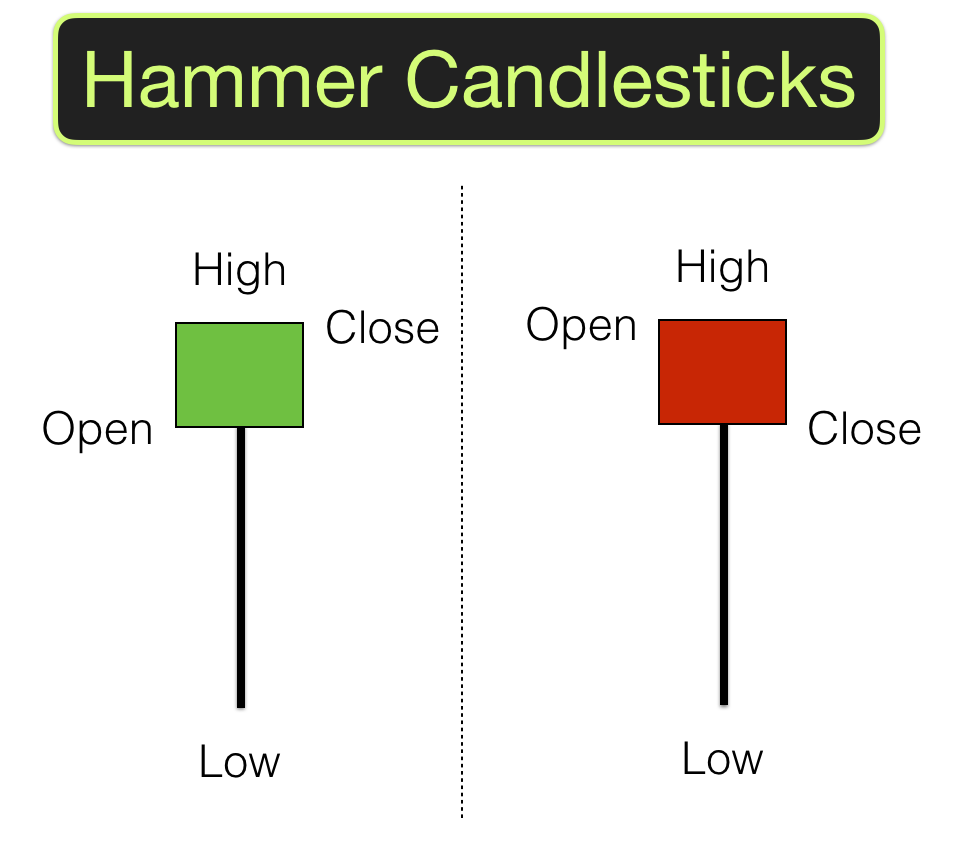

Hammer Charts Candlesticks - Web valentine's day planks & rounds gallery. Web when you see a hammer candlestick form around a key support level such as a trendline, a horizontal price line, a fibonacci retracement level, a round number, or an important. Bullish hammer and bearish hammer (also known as an. The body represents the range between the open and close prices…. Web in his book japanese candlestick charting techniques he describes hammer patterns with the following characteristics: Create advanced interactive price charts for $indu, with a wide variety of. Symbol summary acp point & figure galleryview seasonality options perfchart. Web structure and interpretation of a hammer candlestick. The pattern is formed at the bottom after a downtrend. Here are the key characteristics: The real body is small and located at the upper end of. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close. Web hammer candlestick patterns occur when the price of an asset falls to levels that are far below the opening price of the trading period before rallying back to. It signals that the market is about to change trend direction and advance. The body represents the range between the open and close prices…. Web what is a hammer candlestick pattern? Using a hammer candlestick pattern in trading; The hammer candlestick pattern is. The pattern is formed at the bottom after a downtrend. Bullish hammer and bearish hammer (also known as an. Symbol summary acp point & figure galleryview seasonality options perfchart. The hammer signals that price may be about to make a reversal back higher after a recent. Web what is a hammer candlestick? This is for informational purposes, not for booking a workshop. The hammer is candlestick with a small body and a long lower wick. The body represents the range between the open and close prices…. Symbol summary acp point & figure galleryview seasonality options perfchart. Bullish hammer and bearish hammer (also known as an. Recognize hammers by their t shape, short. We aid in the selection of. Shares of my size, inc. Web the hammer candlestick pattern is a bullish candlestick that is found at a swing low. The pattern is formed at the bottom after a downtrend. This pattern is typically seen as a bullish. Symbol summary acp point & figure galleryview seasonality options perfchart. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. Browse our collection of love themed planks and rounds. There are two types of hammer candlesticks: Web hammer candlestick patterns occur when the price of an asset falls to levels that are far below the opening price of the trading period. The hammer signals that price may be about to make a reversal back higher after a recent. Web the hammer candlestick pattern is a technical analysis tool used by traders to identify potential reversals in price trends. Web in his book japanese candlestick charting techniques he describes hammer patterns with the following characteristics: Advantages and limitations of the hammer chart. Web jun 11, 202406:55 pdt. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. Bullish hammer and bearish hammer (also known as an. Web the hammer candlestick pattern is a technical analysis tool used by traders to identify potential reversals in price trends. Web what is a hammer candlestick? Bullish hammer and bearish hammer (also known as an. Web the hammer candlestick pattern is a technical analysis tool used by traders to identify potential reversals in price trends. The hammer candlestick pattern is. The pattern is formed at the bottom after a downtrend. Create advanced interactive price charts for $indu, with a wide variety of. Things to do near orlando. Browse these collections to view a sampling of our design. Eur/usd approaches the june high (1.0916) as it stages a. Advantages and limitations of the hammer chart pattern; We aid in the selection of. The wicks show the highest. This pattern is typically seen as a bullish. Web what is a hammer candlestick? Browse these collections to view a sampling of our design. The real body is small and located at the upper end of. The real body is small and located at the upper end of. There are two types of hammer candlesticks: This is for informational purposes, not for booking a workshop. Advantages and limitations of the hammer chart pattern; Chart prepared by david song, strategist; Eur/usd approaches the june high (1.0916) as it stages a. Web a hammer is a bullish reversal candlestick pattern that forms after a decline in price. This is for informational purposes, not for booking a workshop. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. Create advanced interactive price charts for $indu, with a wide variety of. Web a hammer candlestick has a very unique and identifiable shape on a chart. The body represents the range between the open and close prices…. Here are the key characteristics: The hammer is candlestick with a small body and a long lower wick. The hammer signals that price may be about to make a reversal back higher after a recent. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close. Web a hammer candlestick formation at a downtrend's end suggests potential trend reversal, often leading to upward price movement. It signals that the market is about to change trend direction and advance. There are two types of hammer candlesticks: The wicks show the highest. The hammer candlestick pattern is.Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

Hammer Candlestick Pattern A Powerful Reversal Signal Forex

Hammer Candlestick Pattern Trading Guide

Hammer Candlestick What Is It and How to Use It in Trend Reversal

What is a Hammer Candlestick Chart Pattern? LiteFinance

Powerful Hammer Candlestick Pattern Formation, Example and

How to Read the Inverted Hammer Candlestick Pattern? Bybit Learn

What is a Hammer Candlestick Chart Pattern? LiteFinance

Hammer Candlestick Pattern Trading Guide

Hammer Candlesticks Shooting Star Candlesticks

Web What Is A Hammer Candlestick?

Web The Hammer Candlestick Pattern Is A Technical Analysis Tool Used By Traders To Identify Potential Reversals In Price Trends.

Web Hammer Candlestick Patterns Occur When The Price Of An Asset Falls To Levels That Are Far Below The Opening Price Of The Trading Period Before Rallying Back To.

Web A Hammer Candlestick Is A Chart Formation That Signals A Potential Bullish Reversal After A Downtrend, Identifiable By Its Small Body And Long Lower Wick.

Related Post: